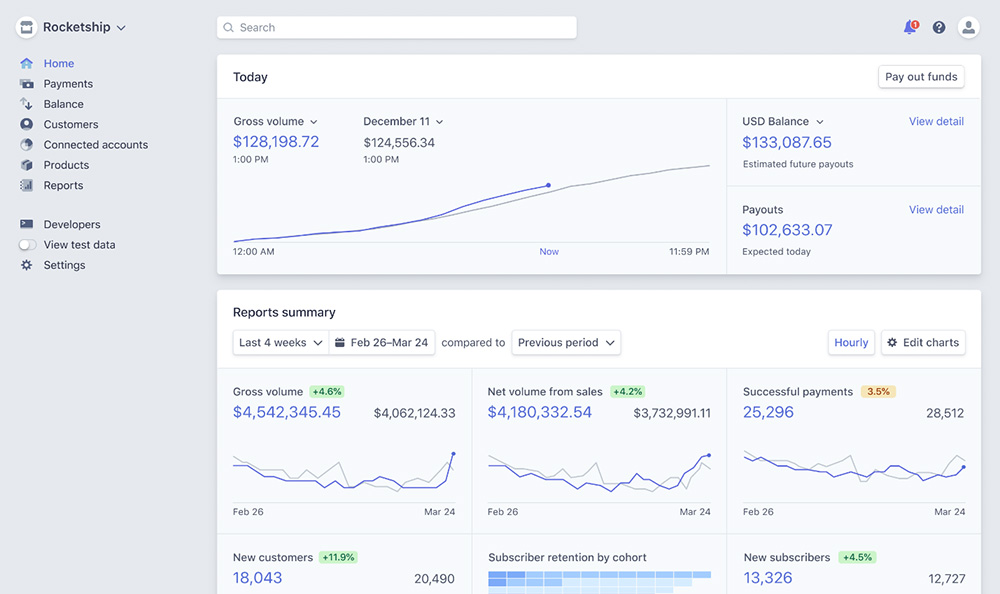

Online businesses struggle with several elements, namely, processing payments, invoices or even the control of revenue per customer. These components are cumbersome to develop and a critical part for the success of any eCommerce business, how can this be optimised securely and reliably? Let us introduce to you to Stripe.

Stripe is an online payment and processing solution for any internet business, allowing to deal with payments core infrastructure seamlessly. This solution has progressed to the best choice of payments over the internet for developers.